The Capital One Card Lab - Make And Customize Your Own Credit Card

Published 5/22/08 (Modified 8/7/14)

By MoneyBlueBook

Have you tried out the Capital One Card Lab program from Capital One credit cards yet? It allows you to build your own custom credit card using a pretty nifty online gadget. This novel web based feature from Capital One represents a promising shift and emerging trend in the credit card business towards providing customers more control and choice over the credit card selection process - by allowing them to create and set the terms and conditions of their credit card rewards and promotional offers. This is a growing movement that I hope is ultimately picked up by the other top credit card companies like Citibank, Chase, American Express, and Discover as well.

While credit cards and financial services in general have a history and reputation of being dry, complex, and frequently confusing, Capital One's new Card Lab online tool tries to make the application and selection process more entertaining and engaging, while still staying informatively functional at its core. The company's improved workshop tool gives customers a glimpse at the future of credit card creation, personalization, and customization. Through its convenient Card Lab website, users and prospective customers are given full informational control of the online application cycle, as the site offers interactive tools that permit them to select from a menu of credit card interest rate terms and rebate rewards to build their own unique credit card program to meet their needs. By providing consumers greater control and manipulative access to all card variations and reward terms in a way that is accessible and organized, the Card Lab program enables them to make more informed and financially responsible choices.

The Attraction and Appeal Of The Capital One Card Lab Stems From Its Interactive Power to Create Something To Call Your Own

The Capital One Credit Card Lab website offers an array of customization options related to interest rate, annual fee, cash back rebates, airline miles rewards, promotional balance transfer offers, and even the print design on the plastic card face. The graphically driven and interactive Capital One card selection tool allows consumers to select the combination of card features that are most important to them and provides an experience that even has an element of fun. The company's attempts to market the Capital One Card Lab as an entertaining financial product selection tool is certainly evident in the way it has been promoting the tool through humorous television commercials and print advertising. While the Capital One Card Lab commercials still tout the obligatory and catchy Capital One "What's In Your Wallet" slogan, one of the goofier Card Lab commercials features a decked out evil galactic empire space ruler and his backdrop army of red robotic soldiers standing at the ready and preparing to exercise the new found triumph and power to create one's own custom Capital One credit card, complete with a picture - of all things, kittens. The quirky request prompts his crazy eyed cyborg sidekick to inquisitively exclaim "War kittens"?! With commercials like that, Capital One is obviously attempting to inject some light-heartedness and fun into the do it yourself build-a-card experience.

The Capital One Card Lab Gets High Marks For Allowing Credit Card Users To Build Their Own Unique Cards, Complete With The Option To Add Their Own Images

If you take a look at how companies are changing the way they do business these days, it's not hard to see that the newest emerging tend is geared towards offering the ability to customize and personalize. Companies are finally starting to realize that one size does not always fit all and that it can be more profitable for them to market customizable variations rather than trying to pigeon hole one type to fit everyone. Because people are different, what may be suitable for one individual or lifestyle may not be the most appropriate package for another. For example, when it comes to credit card offers, I personally prefer reward credit cards that provide cash back rebates, airline miles rewards, or some other form of high percentage back purchase incentive. Of course the downside is that reward credit cards tend to impose higher interest rates than non-reward credit cards, but it's a tradeoff I recognize and accept. But at the same time, not everyone is interested in purchase rebate rewards. Some are content with not having any purchase incentives, and prefer the peace of mind of having a fixed low interest rate credit card. Others seek card offers for the credit card sign up promotions that they offer exclusively, while others look to credit cards as a potential source of interest free loans through balance transfer offers. Some consumers actually care what the design and color of their plastic card looks like, while other couldn't care less. The concept of different strokes for different folks is very true - which makes the ability to build your own credit card a very attractive option. After all, vehicle manufacturers already allow us to go online and design our custom dream cars, complete with optimized color and features, and online music stores already allow us to pick and choose our individual songs rather than have to purchase an entire music album - so why not credit cards?

If you take a look at how companies are changing the way they do business these days, it's not hard to see that the newest emerging tend is geared towards offering the ability to customize and personalize. Companies are finally starting to realize that one size does not always fit all and that it can be more profitable for them to market customizable variations rather than trying to pigeon hole one type to fit everyone. Because people are different, what may be suitable for one individual or lifestyle may not be the most appropriate package for another. For example, when it comes to credit card offers, I personally prefer reward credit cards that provide cash back rebates, airline miles rewards, or some other form of high percentage back purchase incentive. Of course the downside is that reward credit cards tend to impose higher interest rates than non-reward credit cards, but it's a tradeoff I recognize and accept. But at the same time, not everyone is interested in purchase rebate rewards. Some are content with not having any purchase incentives, and prefer the peace of mind of having a fixed low interest rate credit card. Others seek card offers for the credit card sign up promotions that they offer exclusively, while others look to credit cards as a potential source of interest free loans through balance transfer offers. Some consumers actually care what the design and color of their plastic card looks like, while other couldn't care less. The concept of different strokes for different folks is very true - which makes the ability to build your own credit card a very attractive option. After all, vehicle manufacturers already allow us to go online and design our custom dream cars, complete with optimized color and features, and online music stores already allow us to pick and choose our individual songs rather than have to purchase an entire music album - so why not credit cards?

The functional and marketing appeal of Capital One's Card Lab is rather ingenious if you think about it. While the Card Lab site may seen a bit whimsical and silly with its interactive graphics and functions, the company truly understands that the best way to build prospective customers into loyal and active card users is to get them to develop an emotional bond or attachment to a particular product so that they'll want to use it over the other credit card options sitting in their wallets. Frequently this emotional and personal attachment comes from having had a hand in the product or service's creation.

I remember when I designed and customized my very first own vehicle using the manufacturer's online web tool before visiting the car dealership to purchase it. When I finally bought it, there was something very personal and unique about the car that I wouldn't have been able to feel if I was merely told the car came in only one style, with no distinctive accessories or additions, and only in one color choice - like one of those old black Model T Fords in the old days. Similarly, I remember back when I was a freshman in college and stumbled upon an online application for a Garfield cartoon branded credit card that I decided to apply for. While the card offered no significant reward benefits or provided any special interest rate offer, I was still intrigued and got a kick out of carrying around a Garfield adorned card. Everytime I pulled the credit card out at the supermarket, the person operating the cash register would always smile and make a pleasant remark about it. The Garfield card certainly got noticed. While there was nothing particularly special about the card other than having a big Garfield cartoon picture on the face of it, I felt unique and differentiated by just having it.

The Capital One Card Lab Tool Also Gets Positive Reviews For Its Interactivity and Ability To Easily Mix and Match Credit Card Offers

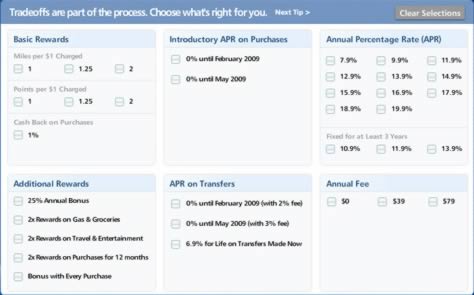

One of my big likes about the Capital One Card Lab program is the ability to easily sort through all available Capital One credit card offers with a few clicks of the mouse. Simply by selecting a few card features, the user gets to see how their give or take selection of certain preferred options affect the ability to have other card features. The Capital One Card Lab offers a whole new area of credit card transparency and financial awareness for consumers, enabling them to see in real time the trade-offs that are necessary to create the credit card that works for them. As choices are made, the Card Lab tool narrows the options in the remaining categories, eliminating options that don't work together. For example, consumers who are willing to select higher interest rates may be entitled to higher cash back reward percentages for purchases, and those who are willing to pay a small annual fee can earn rewards and frequent flyer airline miles faster. The Capital One Card Lab also provides important education into key credit card account terms while the applicant moves along the process. By proceeding through the step by step selection program, card applicants are given the interactive and important opportunity to understand the key trade offs to the choices they make.

To start making your own custom Capital One credit card with Card Lab, just hit the "Get Started"���� link, and you'll start the design process. Based on your FICO credit score, first select your credit level among "Excellent"����, "Above Average"����, "Needs Improvement"����, and "Limited History"����. Then, you can choose from the following card features: "Basic Rewards", "Additional Rewards"����, "Introductory APR on Purchases", "APR on Balance Transfers"����, "Annual Percentage Rate (APR)", and "Annual Fee"����. As you click on various options, you'll notice that the option selection process is an inherent give or take as certain more lucrative rebate rewards will result in certain other offers being moved off the table. You can certainly try to create the world's best credit card offer by choosing all the best rewards and credit card promotions to its maximum potential, but not surprisingly, you won't be able to select a super credit card offer featuring 2% cash back for all purchases with double 2x rewards for gas, groceries, and travel, with a 12 month 0% APR balance transfer and purchase period, with 6.9% APR, and no annual fee. Of course, it doesn't hurt to try and you can always play around with the Capital One Card Lab to see what options preclude what features.

Note that all of your card choices will obviously come with the standard and usual Capital One credit card benefits such as having no foreign currency transaction fee, regardless of what Card Lab features you select. Capital One is one of only a tiny number of major credit card issuers that don't charge foreign currency fees for transactions made overseas and abroad. All of the other major issuers including Citibank, Chase, and American Express levy them to different degrees.

Finally, after having selected your card reward features and satisfied your what-if curiosity through the mix and matching card selection process, the most interesting and perhaps most attractive credit card customization feature of the Capital One Card Lab is the ability to choose the custom image or graphical design that will be printed on your new plastic card. The graphic isn't just a tiny photo of your face that appears on some Citibank Platinum credit cards, but rather encompasses the entire face of the card. While the program currently requires applicants to get approved for their Capital One credit card before they can send in their own custom card design to be printed on their card, the company is actively working towards allowing customers the ability to upload their own images onto the credit card right from the start during the application process. Can you imagine the variety of custom photos, graphics, and designs you could put on it? You could put a family portrait photo shot on your new Capital One credit card or you could put an image of your beloved pet dog, cat, or parrot on it - anything that suits your fancy. All of these customization tools and educational features of the Card Lab process certainly will help the company go a long way in building long term customer loyalty and confidence.

While Having The Complete Freedom Of Options And Power To Build Your Own Credit Card Offer Can Be Overwhelming and Hassling For Some, The Capital One Card Lab Does A Good Job Of Making It Easy

Personally, I love having a lot of choices at my disposal, but at the same time, I understand why certain people might not welcome an interactive tool that features the ability to maximize and customize. The Capital One Card Lab software does take a little bit of tinkering around to figure out what program offer works the best for you. While I already understand the tradeoff system inherent in all credit card terms and already know what type of rebate rewards I seek in my ideal credit card offer, many don't. One can liken it to standing in front of the toothpaste, soap, or shampoo section at the supermarket. The wealth and variety of personal hygiene products, brands, and terminologies at your local grocery store shelf can be a bit mind boggling at times. Sometimes having too many options can make the selection process for the perfect product a bit daunting. While I think the Capital One Card Lab does a very good job of organizing all of their card offer options into an easily accessible and mildly amusing interactive program for consumers, I suppose there will always be some lazy people (like my brother) who prefer to have their standard credit card options narrowed down to a recommended few and essentially handed to them.

January 1, 1970 at 12:00 am