Peer-to-peer lending can benefit borrowers and lenders

By Peter Andrew

Last year, my sister and brother-in-law wanted to remodel their kitchen. They both have good, secure jobs and great credit scores, and could easily have raised the money they needed, even in this economic climate. However, at the same time my mom had quite a hefty balance in a high yield savings account. With bank rates running low, it didn't take them long to work out that my mother could earn more interest, and my sister pay less, if they cut out the bank, and worked out loan terms between themselves.

And that, in essence, is what peer-to-peer lending (a.k.a. person-to-person or P2P lending ) is all about. By eliminating the costly overheads and shareholder profits of banks (not to mention those bonuses), a loan between individuals can make both the borrower and lender better off. None of this is new. Families and friends have been helping each other out for millennia.

P2P lending web sites

What is new is the worldwide web. This allows strangers to lend and borrow through a middleman website that charges a small fraction of the mark-up that banks take for, in effect, brokering a loan. The first of these sites in America, Prosper, began in 2006, and by October 2010 had attracted more than a million members and had funded $205 million worth of loans.

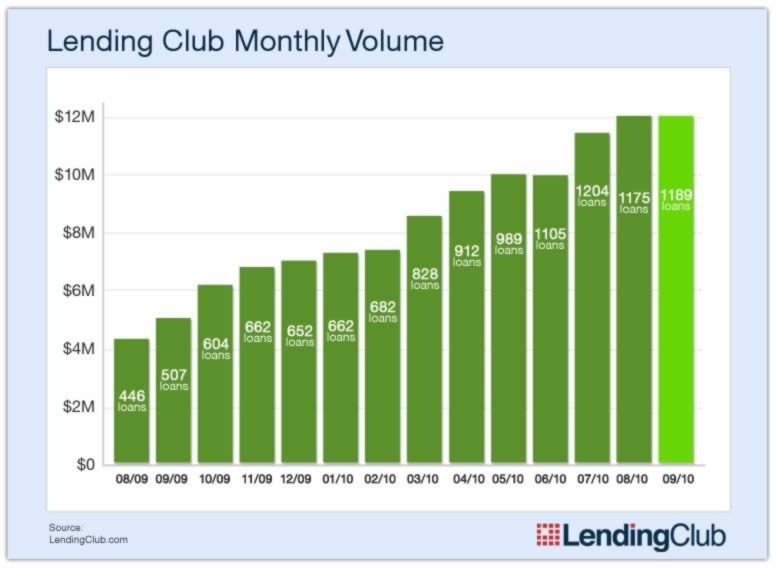

The other big player in this country is Lending Club, which was founded the following year and, also by October 2010, had funded 17,630 loans worth over $170 million.

Buddy, can you spare a dime?

You've already spotted the flaw in this model. You wouldn't lend your hard-earned cash to some guy who walked up to you in the street and asked for money, so why would you do so to a total stranger whom you'd never even met?

Well, Prosper, Lending Club and other similar sites do all they can to tell you what you need to know about that stranger. Prosper lets pretty much anyone post a request to borrow money, but it also allows prospective lenders to view each person's history, credit details and loan-to-income ratio. Lending Club goes even further. It vets every loan application before it's posted, and 90 percent of those never make it onto the site. And it too provides detailed information on every borrower.

Risky business

If you're really smart, you may have spotted another problem. Prosper was founded in 2006, Lending Club in 2007, and in 2008... we saw the biggest crash in recent history. People lost huge sums of money in real estate and the stock market. And some did--although usually smaller sums--in peer-to-peer lending too. And, of course, these person-to-person loans aren't secured by FDIC insurance.

Let's face it, hard-nosed bank managers and credit card underwriters--all of whom were trained professionals who know a thing or two about risk--also had enormous losses. The same applied in P2P lending. Those who lent to people with poor credit in return for 20 percent plus rates tended to take the biggest hits.

That may explain why Lending Club claims that many fewer of its members--especially those who spread risk widely--made losses than those in some other programs. Its pre-screening prevented lenders from making sub-prime loans.

Eggs and baskets

Of course, not everyone made losses, which is, presumably, why these sites are not only still in business, but also adding lenders and borrowers all the time. And there are ways to spread your risk.

Suppose you have $10,000 to invest. You'd be either mad or very brave to hand the whole lot over to one stranger, no matter how stellar his or her credit score is.

A better strategy is to put a bit of your lump sum into a number of loans--up to 400, in fact. Because $25 is the minimum you can put into one loan note. Now, the only way you could lose all your money would be if all 400 defaulted before their first payments were due, an exceedingly unlikely scenario even today.

Rates

Prosper rates are largely determined by the borrower, who states the highest he or she is prepared to pay. Lenders then review the file, and decide whether or not to invest by balancing risk against return. They can bid under the highest rate that the borrower has indicated, and--when the full amount needed has been subscribed--those who bid the lowest get to make the loan. Obviously, borrowers who set their rates too low don't get their loans.

Lending Club operates differently. It sets the rate (usually between eight percent and 25 percent) in accordance with its appraisal of the credit risk. Because this site pre-screens borrowers, pretty much 100 percent of applications that appear succeed.

The way forward?

There hasn't been a significant part of the financial sector that's escaped the dire consequences of the recent recession. And peer-to-peer lending is no exception. But there are many signs of things improving, and both borrowers and lenders--such as my mom and sister--are again discovering the benefits of person-to-person lending.

Peter Andrew has been writing about--and for--business for more than two� decades. For the last couple of years, he has found himself� increasingly specializing in the U.S. financial sector.

January 1, 1970 at 12:00 am