No Rush To Pay Off My Student Loans

Published 10/8/07 (Modified 3/9/11)

By MoneyBlueBook

This is my first entry about my student loans. For starters, I think I am very lucky compared to some people. As of today, I only have about $30,000 in student loans left from my college and graduate school days. Aside from the prestige or other benefits of attending more expensive private schools, I feel fortunate to have stuck with more affordable state schools for my undergraduate and graduate education. As a result, I'm not living a life of student loan servitude like many of the people I am reading about in the news, and personally am in no particular rush or hurry to quickly pay off my student loans.

Student Loan Debt Is A Massive Burden To Many

Student loans never go away and can't even be discharged through bankruptcy. The student loan creditors will essentially come after you until you eventually pay it off, a sobering reality that many students don't fully comprehend or realize until they've graduated. I truly sympathize with their burden and know how much of a shackle it can be. I have friends who graduated from law school and medical school carrying tremendous six figure student loans. Even with their advanced degree education, in today's market, there is no easy guarantee that they will have a breezy way of paying it off.

But I Am Taking My Time Paying Off My Loans Thanks To Low Interest Consolidation

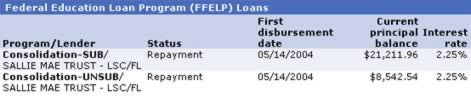

I am fortunate to have consolidated my student loans at the lowest rate seen in the last decade or so. I finished graduate school in 2003 with a combination of variable and fixed rate student loans, which were at a relatively low 3.42% at the time. In May 2004, I consolidated my Sallie Mae loans into a very low fixed rate and since then, I've taken advantage of every borrower benefit available to lower my rate.

I applied for Sallie Mae's Smart Loan Direct Repay, which drops your interest rate by a .25% discount if you make your monthly loan payments through automatic debit. I also later qualified for the SLMA Consolidation Savings Options, which provides you a further 1.00% interest rate discount if you make your scheduled monthly payments consistently for 3 years straight.

Currently my total student loans are consolidated at a very low fixed interest rate of 2.25%. I am definitely going to take my time in paying off my loans. Because I was able to consolidate at such a low rate, I am better off keeping my money in an interest bearing account earning more than 5.00% than I am in quickly paying off the loan. If there's any type of debt that can be considered "good debt" this one is it. Not only can I get more money by not paying off the low interest loan in full right away, I can also qualify for a tax deduction for the student loan interest that I pay.

Maybe it's also a psychological cushion factor, but I would much rather have $30,000 in the bank and be $30,000 in debt, than I would having $0 in the bank with no debt.

January 1, 1970 at 12:00 am