My Not So Diversified High Rate of Return Portfolio

Published 9/19/07 (Modified 3/14/11)

By MoneyBlueBook

As was expected, the Federal Reserve cut a key short term interest rate yesterday by a half percentage point to 4.75%, sending investors into a frenzy. Investors went bonkers and jubilantly bought shares, sending the U.S. and world stock markets soaring. The Fed also indicated that more rate cuts could be on the way. Interestingly, federal funds futures on the Chicago Board of Trade are now pricing in a 100 percent chance that the Fed will cut rates at least one more time before the end of the year.

I have to applaud the Fed for being gutsy enough to take aggressive action amid the credit and mortgage market meltdown. While this certainly won't solve the sub prime mortgage mess immediately, at least it's a move in the right direction. I personally think the housing recession still has a long ways to go before recovering. But why am I still very skeptical that this resurgence is for real? That's probably why I still have un-invested cash on the sidelines, waiting for the right opportunity.

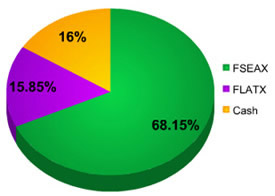

My Current Investment Portfolio for 9-19-07

I logged onto my Fidelity Investment account at the close of trading and took a peek at my gains for the day. My portfolio was up 5% due to the Fed's announcement, a remarkable one day gain with impending recession fears only a few weeks ago. With today's Fed announcement, I think now is a good time to evaluate my investment portfolio and financial strategy. And it's a doozy.

Looking at my portfolio it's plain to see that I have a very un-diversified and growth oriented mix. I have indeed enjoyed a very profitable year to date as my funds have performed exceedingly well. My approximate rate of return on the year is nearly 25%. However, I still have a ways to go in properly planning out my financial future. My portfolio is rather risky as all of my investments (including 401k and Roth IRA) are currently in foreign stocks.

Approximately 68% is in the Fidelity South East Asia Fund (FSEAX), 16% is in the Fidelity Latin America Fund (FLATX), and the remaining 16% is being held in Fidelity Cash Reserves (FDRXX). What can I say? At my stage in life I am willing to tolerate a lot of risk for the opportunity to rake in a high rate of return. I stick with mutual funds though to minimize the potentially disastrous effects of a single stock getting hit by unforeseen bad news.

As I previous indicated, given a long enough investment horizon, the stock market has always cumulatively trended upwards. The greatest growth potential can be found in Asia and so that is where I have chosen to invest my money.

However, in the coming months and years, as my investment horizon naturally shortens and my life priorities change, I will begin diversifying and reallocating my investment holdings to minimize my risk exposure.

January 1, 1970 at 12:00 am