The Stock Market - What Goes Down Must Come Up

Published 8/16/07 (Modified 3/9/11)

By MoneyBlueBook

The world stock markets have been rather volatile lately with major highs and lows. These days I'm almost afraid to turn on CNBC and watch the financial news or log into my brokerage account to check my investment portfolio balances. There seems to be a gloomy cloud over every investor I know.

Time to Keep Things In Perspective - Volatility is Not a Roller Coaster

When things get hairy, cooler heads must prevail, but at times it's understandably difficult to do so. When prices are plummeting as they are now, and when panic selling grips the market, it is easy to get caught up in the wave. However, I urge you to keep things in perspective. Many equate a volatile stock market to that of a roller coaster ride, but the problem with that analogy is that with a roller coaster ride, you end up in the same position you were in when you started. But that's not necessarily the case with volatility since market upside has always led to an upward trend in the long term despite occasional wild swings.

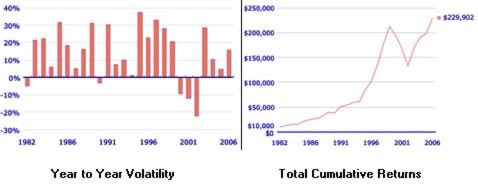

Take a look at these charts based on data from the S&P 500:

- The chart on the left shows the total yearly percentage returns of the S&P 500 over 25 years. See how market volatility can create seemingly wild roller coaster-like ups and downs?

- But then take a look at the chart on the right. It uses the same S&P 500 data, but instead of showing it from year to year, it shows the total cumulative return over the long term - clearly an upward trend.

If we can learn to think in the long term and not focus so much on short term market swings, we'll all weather the storm better. Keep things in perspective - Focus on the long term, invest regularly in diversified instruments, take advantage of dips, and we'll all profit in the long term.

January 1, 1970 at 12:00 am