CNBC's Jim Cramer Advises Investors - "Bear Stearns Is Fine, Don't Be Silly"

Published 3/18/08 (Modified 3/9/11)

By MoneyBlueBook

This is so classic. On March 11, 2008, this financial commentary by "financial guru" Jim Cramer was featured on his popular Mad Money television show on CNBC. The customary Cramer angry rant was made in response to a call and write-in question about the serious viability and liquidity concerns regarding Bear Stearns, one of the world's largest global investment banks and brokerage firms, and a company that has been hit particularly hard by the subprime mortgage meltdown. The abbreviated Mad Mail question and exchange can be viewed on Jim Cramer's CNBC Mad Money Blog. Frankly, his response should be written in all caps, since he tends to holler his answers. I wouldn't be surprised if Jim Cramer later requests to have it take down out of sheer embarrassment.

This is so classic. On March 11, 2008, this financial commentary by "financial guru" Jim Cramer was featured on his popular Mad Money television show on CNBC. The customary Cramer angry rant was made in response to a call and write-in question about the serious viability and liquidity concerns regarding Bear Stearns, one of the world's largest global investment banks and brokerage firms, and a company that has been hit particularly hard by the subprime mortgage meltdown. The abbreviated Mad Mail question and exchange can be viewed on Jim Cramer's CNBC Mad Money Blog. Frankly, his response should be written in all caps, since he tends to holler his answers. I wouldn't be surprised if Jim Cramer later requests to have it take down out of sheer embarrassment.

This is what blindly listening to the advice and commentary of financial gurus and pundits in the mainstream financial media outlets like CNBC will get you:

Tuesday, March 11, 2008 On Mad Money

- Dear Jim: "Should I be worried about Bear Stearns in terms of liquidity and get my money out of there?" - Peter

- Jim Cramer: "No! No! No! Bear Stearns is fine. Do not take your money out. Bear sterns is not in trouble. If anything, they're more likely to be taken over. Don't move your money from Bear. That's just being silly. Don't be silly."

Friday, March 14, 2008:

With liquidity problems snowballing and financial conditions deteriorating, Bear Stearns reaches for a life preserver, and works out a financial rescue deal with JP Morgan Chase and the United States Federal Reserve to help keep the 5th largest U.S. bank afloat. Bear Stearns' chief executive, Alan Schwartz, explaining why the bank turned to the Fed and a rival bank, said:

- "Our liquidity position in the last 24 hours had significantly deteriorated. We took this important step to restore confidence in us in the marketplace, strengthen our liquidity and allow us to continue normal operations." (Reuters).

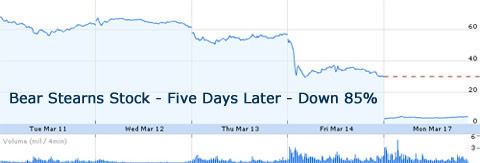

With the mood deathly grim and takeover speculation rampant, investors bail - sending Bear Sterns stock price plunging on record volume, losing more than 45% of its total market capitalization in one fell swoop.

Sunday, March 16, 2008, And The Day After

Facing the brink of imminent collapse and financial insolvency, Bear Stearns is bailed out and acquired by JP Morgan Chase, preventing the worst case scenario of bankruptcy protection. The company is acquired for only a tiny fraction of what it was once worth at a mere $2 per share for a total all stock deal of $236 million. The Federal Reserve agrees to provide additional funding to help the dying bank and prevent widespread panic and frenzy (CNN). Next day, the price of Bear Sterns stock plunges by almost 85%, sending deathly chills down the back hairs of all investment banks and those in the financial sector. Companies that dabbled in subprime mortgage backed securities continue to wait anxiously for the credit crunch guillotines still making their rounds.

My Take On Jim Cramer's Advisory Statement and The Moral Of the Story

While Jim Cramer's statment about Bear Stearns seems utterly ridiculous now, on the flip side, there is a slight possibility that perhaps he wasn't addressing the stock price of Bear Stearns but rather those customers who had investment and brokerage accounts held at the ailing company. He didn't exactly recommend that investors buy or hold Bear Stearns stock in that particular comment, although, he has made such comments in the past. If the latter was what he meant, Jim Cramer, as an educated financial commentator, should have framed his comment better by addressing FDIC and SIPC protections to alleviate account holder concerns. But instead of discussing the relevance of broker bankruptcy protections, he chose to address the performance and on-going concern issues of Bear Stearns. This leads me to believe he was in fact rendering an opinion about Bear Stearns as an equity investment, and was completely blindsided by the investment banker's later revelations about its liquidity.

...Which leads me to the whole point of this article. Do not believe everything you hear from financial pundits and so-called experts or gurus. All investors should learn to perform their own research and due diligence. No one can predict the movement of market action and stock prices. While the stock market is inherently designed to be efficient with demand complimenting supply, the truth of the matter is that not all crucial information is in the public domain. As someone who works in a legal field with some first hand and indirect observation of what goes on behind the scenes, I can assure you that there is a lot of inside trading and underhanded conflict of interest transactions going on, despite the SEC, DOJ, and FTC's valiant attempts to root out the evil do-doers.

The movement of the market is also heavily influenced by the emotional lemming-like horde mentality of investors. Like ESPN sportscasters, financial reporters can only truly and accurately report what they observe on the spot. No one has the magical crystal ball to see into the future. They may attempt to make reasonable projections, but those stock picks, like March Madness basketball pool selections, are frequently wrong. The only way to weather investment storms and financial unpredictability, is to remain diversified and invest in broad stock indexes such as low commission mutual funds and exchange traded funds (ETF's).

January 1, 1970 at 12:00 am