Because of Dollar Cost Averaging, I Am Happy When My Stock Investment Portfolio Goes Down

Published 11/9/07 (Modified 3/9/11)

By MoneyBlueBook

For the past week, my stock investment portfolio has been taking a massive beating. Many of my Asian emerging market funds that were previously delivering great returns have suffered greatly, along with the rest of the world financial markets. But am I worried? Nope, not the least bit. When I see all the red numbers on CNBC, I just smile. It's a healthy market correction that needs to happen from time to time.

My Funds Have Tanked Before and I've Always Recovered Plus More

In February, my portfolio plummeted almost 10 percent. I was ecstatic. Why? Because when the market dips that much, it signals a very attractive buying opportunity. I know with a long enough investment horizon, historically, the market has always cumulatively trended upwards. I am confident in my belief that every cent I invest now will very likely pay off in spades in the distant future. I see dips as the efficient market at work so I always try to take advantage of every attractive buying opportunity.

In turbulent times, it's best not to mess with your investment portfolio. Some are whispering about the possibility of recession and suggesting that the housing and mortgage-linked credit crisis will drag down the American economy, and in turn pull the rest of the world financial markets down with it. But I urge everyone not to be too hasty or emotionally driven in their financial decisions. Try to stay cool as a cucumber.

Come Out Ahead Of the Market By Continuing to Invest

The single most important thing you can do now is to stick with your original investment strategy. If you have a 401k, or Roth IRA account, continue investing regularly and resist the urge to sell and sit on your hands on the sideline. In fact, because I stayed the course and continued to invest regularly when the market tanked in February and later in July of this year, I am now better off than if the market had remained flat or even remained at a steady upward trend during this entire time.

The single most important thing you can do now is to stick with your original investment strategy. If you have a 401k, or Roth IRA account, continue investing regularly and resist the urge to sell and sit on your hands on the sideline. In fact, because I stayed the course and continued to invest regularly when the market tanked in February and later in July of this year, I am now better off than if the market had remained flat or even remained at a steady upward trend during this entire time.

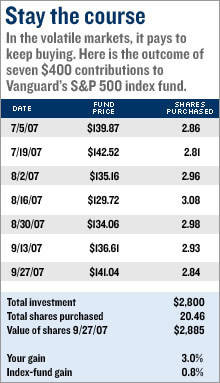

Take a look at the example demonstrated by the graphic from CNN Money on the left. Because the fund price fluctuates, the amount of shares that can be bought with each fixed contribution changes. At the end, although the fund only gained 0.8%, your total overall gain would be 3.0%. Despite prices dips, you still come out ahead overall.

The Reason For This Is Due To Dollar Cost Averaging

So long as you continue to invest regularly, even during periods of sell off in the stock market, you will be able to regularly buy in at lower prices. By consistently buying the price dips, this lowers your overall cost since more shares are being bought when prices are low than when prices are high. As long as you have a long enough investment horizon, your portfolio will be much higher in the long run due to your continued purchases at regular intervals and captures of these dips.

Of course this assumes that you have a steady outside income that is generating the extra money for you to invest on a regular basis. It also assumes that there is no prolonged bear market that will exceed your investment horizon. But if you need the money before the bear market turns into a booming bull market, you will likely be at a loss either way.

January 1, 1970 at 12:00 am