Federal Tax Brackets 2009

Published 4/22/09 (Modified 6/17/11)

By MoneyBlueBook

Update: Projected Have Been Released!

The following represents the Internal Revenue Service (IRS)'s officially released 2009 federal income tax brackets. Read 'em and weep - or perhaps rejoice, depending on where you stand on the whole federal income tax bracket sliding scale. Regardless, you're going to be getting close and personal with the marginal rates when you file your 2009 tax return in early 2010. Let's have a look at some of the tax changes shall we?

Official IRS Tax Rate Schedule Updates For Tax Year 2009

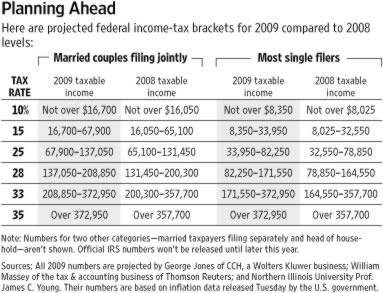

![]() Via the Wall Street Journal, the following graphical table below gives you the official marginal tax brackets for married couples filing jointly as well as the marginal rates for single filers for 2009. The previous year's numbers are also provided to give you an idea of some of the more noticeable changes since 2008. The income numbers listed in the chart below are taxable incomes, and thus they have taken into consideration all available personal exemptions as well as any of either the standard or itemized deductions, including all pre-tax above the line 401k and deductible IRA contributions.

Via the Wall Street Journal, the following graphical table below gives you the official marginal tax brackets for married couples filing jointly as well as the marginal rates for single filers for 2009. The previous year's numbers are also provided to give you an idea of some of the more noticeable changes since 2008. The income numbers listed in the chart below are taxable incomes, and thus they have taken into consideration all available personal exemptions as well as any of either the standard or itemized deductions, including all pre-tax above the line 401k and deductible IRA contributions.

As key portions of the marginal tax tables are pegged to inflation, quite a few numbers must be annually revised. Thus you will note that there are quite a few key changes for the 2009 tax year compared to the year prior. However, while overall tax numbers appear to have nominally increased on the whole, taking into consideration the effects of inflation, effective tax rates may actually have remained level or even dipped a bit.

Despite the text below that says "projected", the official IRS numbers have been released and they now represent official federal income tax rate brackets, locked in for 2009.

To summarize, here is a run through of some of the more notable tax rate changes for 2009 and even a quick blurb about some of the key tax benefits that did not change based on official IRS releases thus far:

- Personal Exemption and Exemption For Dependents - Increased to $3,650 from $3,500 (up $150) from 2008, but is phased out at higher income levels.

- Standard Deduction - The great majority of American taxpayers take the standard deduction rather than itemizing deductions for expenditures such as mortgage interest, charitable contributions, and state & local taxes. The standard deduction increased to $11,400 from $10,900 (up $500) for married couples filing a joint tax return, increased to $5,700 from $5,450 (up $250) for singles and married individuals filing separately, and increased to $8,350 from $8,000 (up $350) for heads of household.

- Overall Tax Bracket Thresholds - Increased across the board for all tax filing statuses. This means that if your annual income did not increase since last year or if you did not receive an inflation based pay raise, you may likely pay a little less in taxes in 2009 than in 2008. As the IRS notes as an example on one of its press releases, in regards to a married couple filing a joint return, the taxable income threshold separating the 15 percent bracket from the 25 percent bracket is $67,900, up from $65,100 compared to tax year 2008.

- Earned Income Tax Credit - Increased to $5,028 from $4,824 (up $204) for low and moderate income workers and working families with two or more children. The income qualification limit to take the earned income tax credit (EITC) for joint return filers with two or more children also increased to $43,415 from $41,646 (up $1,769).

- Annual Gift Tax Exclusion Amount - Increased to $13,000 from $12,000 in 2008 (up $1,000). Often overlooked by people, the gift tax requires the gift giver to pay a special tax on the gift amount if it exceeds a certain amount per year. For 2009, that threshold will be bumped to $13,000.

- Social Security Contribution and Wage Benefit Base - Increased to $106,800 from $102,000 (up $4,800). This means that 2009 income sources over $106,8000 will not be subject to Social Security taxation. With the Social Security tax rate at 6.20%, this also means that the maximum a person will shoulder in Social Security taxes for 2009 is $6,622.

- Traditional and Roth IRA Contribution Limits - No change from 2008. Despite inflationary pressures that increased tax bracket rates across the boards, sadly, IRA and Roth IRA contribution limits will be staying the same - stuck at a crappy and paltry $5,000 per year for those under age 50, and $6,000 per year for those 50 or above.

- Roth IRA Contribution Limits (Income Threshold) - Increased to $166,000 from $159,000 (up $7,000) for married filing jointly couples, and increased to $105,000 from $101,000 (up $4,000) for singles and others.

Watch Out For Possible Upcoming 2010 Tax Bracket and Tax Rate Changes

While official IRS federal income tax brackets are not usually released for the following tax year until the late fall, it's frankly never too soon to get your hands on the earliest reliable marginal tax bracket predictions. Year after year, a group of private tax experts and economists associated with the Wall Street Journal get together and crunch officially released inflationary data to provide news readers an early bird peak at the following year's projected income tax brackets. This group, comprised of members from the Tax and Accounting arm of Thomson Reuters, tax analysts from CCH, and an accounting professor from Northern Illinois University - usually releases their annual tax bracket projections and estimations on tax deduction numbers for the following year during early fall (around September), well before the official IRS numbers are issued.

As marginal tax brackets track changes in inflation and other economic data fairly closely, the annual tax rate estimations by the Wall Street tax team members have yielded pretty reliable and on par results over the years. If you're antsy to get a head start on tax year 2010, stayed tuned in very early Fall 2009 for the newest updates on the 2010 projected federal income tax brackets.

Because of the election of Barack Obama as the new President of the United States and the handover of the country to a new political party, there are bound to be substantial changes in the tax code and income tax rates in the coming years. Working on an economic stimulus plan and advocating aggressive social agendas, President Obama has already proposed numerous changes to the ordinary income tax rates, such as raising the top rate from 35% to 39.6% - potentially boosting the tax burdens of higher income earners to new heights. He has also suggested the need to reduce tax deductions for American households earning more than $250,000 annually, and has also made proposals to increase taxes on capital gains and stock dividends. With a political and taxation platform that is decidedly against those those in the higher upper echelons of the U.S. tax code, those who have done well for themselves over the years seemingly have a lot to fear in Mr. Obama. Personally, while I feel Obama is doing a commendable job on the social and foreign policy front, I hope he doesn't get too carried away with his taxation ambitions. His remarks on taxes always make me nervous.

In the mean time, many of us regular taxpayers can only just ride along and hope for the best. Regardless of what Obama ultimately decides to do and no matter how federal income tax brackets eventually look like in 2010 and 2011, we should try to wisely structure our actions today to reduce our future tax burdens as much as possible, regardless of what happens. Such smart tax moves would include taking advantage of employer sponsored pre-tax perks like flexible spending accounts (FSA), and investing���� in tax deferred retirement vehicles like 401(k)'s and Roth IRA accounts.

January 1, 1970 at 12:00 am