What Is My Credit Score and How Is My FICO Calculated?

Published 7/8/08 (Modified 3/9/11)

By MoneyBlueBook

If you're like most people out there, there's inevitably going to come some point in your life when you'll need to apply for credit and seek out deeper pockets to help you fulfill your personal financial goals and objectives. While the traditional American dream of home ownership seemed to be fading out of reach during the last few years, the housing meltdown is now thankfully forcing out of control real estate prices back down into sync with reality. But with the resultant repercussions and reverberations of the financial credit crisis, mortgage lenders have grown extra vigilant in weeding out unproven and unreliable mortgage debtors. While a mortgage applicant with a FICO score of 700 in the past could have easily obtained a lofty prime interest rate on their loan, lenders are now increasingly demanding higher FICO's in excess of 760 for the same prime interest package. The subprime credit mess has made one's credit report and credit score even more important gateway factors to determining who qualifies and who doesn't for the loan conditions of their choice. It's not just for expensive, higher denominational credit prospects like mortgage loans either - even routine applications for things like credit cards, checking accounts, auto loans, and even new jobs are undergoing greater credit worthiness scrutiny.

Both Your Credit Report History and Credit Score Help Determine Your Credit Worthiness, But Credit Scores Are More Uniform Measures Of Comparison From Individual To Individual

While credit reports, like your high school transcript does a better overall job in revealing the compete performance history of the individual, oftentimes, it's the credit score, like the mathematically calculated grade point average (GPA) that is given the greatest initial attention. Like the analogous school GPA's, credit scores are frequently used by major lenders to serve as cut off points to determine who will enjoy speedy approval and those who will require further scrutiny. As such, a high credit score serves up the best first impression when it comes to getting quickly approved for credit cards, car loans, and mortgages. Your complete credit report transcript conveys the rest of your credit history, but it's your credit score that provides that first impression to determine whether you instantly qualify or not. If you've ever wondered why some people can get online and get instantly approved for a credit card in seconds, that's because their credit scores are likely so remarkably high, credit card issuers feel they have more than enough information right off the bat to grant application approval. The same can be said for pre-qualification terms for mortgage or auto loans for favorable rates.

For those of you who buy into the financial wisdom of some personal finance pundits who advocate a cash only lifestyle and preach against all forms of debt, I personally think that is an all too safe but foolish perspective to cling to. It's not credit or debt that is so evil, it's the lack of financial education and mismanagement that dooms one to failure. Unless you are a millionaire, come from a very wealthy family, or your last name is Gates, Buffett, or Walton (of Walmart fame), you will inevitably need to take on student loans, car loans, or a housing mortgage loan in some form or another sometime during your life span. A cash only lifestyle is appropriate for engaging in small time transactions, but for the pricier car and home buying process, you will inevitably need to call upon your built up credit history and credit score eventually.

So What Is The Purpose Of Having A Good Credit Score And How Is It Calculated?

Your credit score is basically a three digit number that is mathematically generated by credit reporting agencies based on information found on your individual credit report. The credit score is a numeral representation used to assess your past debt payment history and predict your ability to fulfill future debt obligations. Everytime you perform actions or transactions that relate to the extension of credit in the real world, that request for credit is submitted to the three major U.S. credit bureaus (Equifax, Experian, TransUnion) for recordation. By taking that continuously updated information and plugging it into a special mathematical formula, credit bureaus can generate an up to date credit score on demand to accurately predict your present and future ability to pay off incurred liabilities. Positive actions like on-time payment and low credit usage will boost your credit score, while negative events like bankruptcies, foreclosures, and failures to pay on time will hurt your score. Experience and trends have shown that those with higher credit scores are more responsible with credit and are less likely to default on loans. However, because credit transactions are not always equally sent to all big three consumer credit reporting agencies and not all information is processed by all three in the same mistake or error-free way, there are bound to be slight differences and discrepancies among different credit bureau scoring results, even if they all utilized the same credit scoring methodology. Keep in mind, Equifax, Experian, and TransUnion all individually generate their own credit score results on request.

But in general, one's credit score is a fairly uniform mathematical measure of credit worthiness. Banks, credit card companies, and mortgage creditors are in the business of taking on risk, and thus utilize this invaluable scoring system to gauge prospects. In exchange for taking on risk, these institutions are willing to extend you money on loan, but in return they expect to be compensated for the financial risk they take on in the form of additional interest rate payments. Different degrees of risk and possibilities of default demand different levels of interest. If you're a risky debtor with a shaky credit history, you will be required to pay higher interest payments to the creditor to offset the risk. If you are a more reliable debtor, chances are your interest obligations will be a lot less. That is why it is important to keep your credit score high - it's one of the most important things that lenders look at when they evaluate your financial profile. You might be a nice guy or a nice gal, really deserving of credit approval, but if your credit score is lackluster, your chances may be shot.

What Is The FICO Credit Score Made Up Of, and How Are The Scoring Categories Weighted?

When most people speak about credit scores, more likely than not they are referring to the FICO credit score, the popular credit scoring system created by the Fair Isaac Corporation. There are currently several alternative credit scoring systems out there, most notably, the new VantageScore jointly developed by the big three credit reporting agencies, Equifax, Experian, and TransUnion, but the FICO is still the most widely used scoring method. I recommend avoiding the VantageScore for now and staying clear of credit vendors that attempt to hawk it. Because the VantageScore also uses a three digit scoring system but on a different numerical range from 501-990, obtaining it at this time will only serve to confuse you. Because most lenders have not broadly adopted the use of the VantageScore yet, you are better off focusing on the FICO exclusively for now. There really is no particular purpose for consumers or lenders to adopt the VantageScore at this point in time as its development was primarily business motivated rather than designed to benefit the consumer. The credit reporting agencies simply got tired of having to pay royalties to Fair Isaac for utilizing their proprietary scoring formula and wanted to create their own cheaper version. For now, stick with the genuine FICO - it's the most widely used credit score and currently still the most relevant by far.

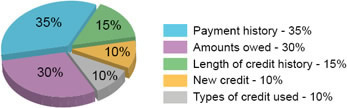

The FICO credit score is formulated on a scale from 300 to 850, however most people will have scores between 600 and 800. It's unlikely to find many people with scores below or above this general scoring range. As a rule of thumb, any FICO score that is above 700 should be deemed good, although in this current market, a FICO of 750 will probably be needed to guarantee you the most favorable loan rates. Here is how the FICO credit score is generated and broken down into its composition categories according to pie chart percentages:

1) Your Credit and Debt Payment History - ( 35% of Your FICO)

This is the absolute most important factor in determining your FICO credit score. To have a high score, you'll need to develop a history of timely and punctual bill payments. When lenders evaluate you as a prospective credit candidate, they want to see that you have a solid history of not only fulfilling debt obligations, but that you also have a track record of paying on time. Past late payments and unpaid debts sent to collections will significantly damage your FICO score. Negative factors like bankruptcy and defaulted payments will hurt your score as well. How badly a failure to pay or a late payment will affect your credit score is determined by the total number of past due items, how long they were past due, and the length of time since your last late payment. Because the payment history category is weighted to favor more recent transactions over older actions on your credit history, it's never too late to start paying on time. Better late than never.

2) Amounts and Balances Owed - ( 30% Of Your FICO)

The second most important factor other than timely payment is the total amount of credit money that you owe and the proportional amount of your total available credit utilized. If you are already carrying a substantial amount of active debt in the form of existing home mortgages, home equity lines, car loans, student loans, or credit cards, you are less favorable as a candidate to take on additional debt. Because of your existing debt obligations, you are seen as a greater potential credit risk. However, your total amount of outstanding debt can be hugely tempered and your risk factor greatly minimized by having a lower debt usage ratio.

Under the FICO formula, someone with an outstanding credit card balance of $900, with a total available limit of $1000 (utilization ratio of 90%) is deemed to be riskier than someone who has an outstanding credit card balance of $2000, but with a total credit limit of $10,000 (utilization ratio of 20%). Being saddled with a lot of debt isn't necessarily bad in terms of your credit score if you are well under your total available credit limit. Obviously the more zero balance revolving credit accounts you have on your credit report the better, but the amount of your credit usage in proportion to your total credit available goes a long way to boosting your score.

Example: As someone who regularly engages in credit card arbitrage, I frequently carrying large 0% APR balances on my 0% balance transfer credit cards. But despite my high credit balances, I maintain a stellar FICO score (FICO of 758), attributable to my low overall credit usage ratio. I might carry credit card balances in excess of $20,000 on multiple cards, but because I have over $80,000 of unused revolving credit available to me, my low proportional usage keeps my FICO high.

3) Length of Your Credit History - ( 15% Of Your FICO)

When it comes to the FICO credit score, the older the credit account, the better. That is why consumers are sometimes encouraged to initiate credit usage at an earlier age, if only for the sole purpose of building up credit. College students are sometimes advised to open at a least one student credit card for the purpose of building up a credit history file. Those who stick with cash only and wait till later in life to start opening credit accounts are ultimately short changed when it comes to their FICO scores. The same rationale is also why it is almost never advisable to cancel old credit cards. Unless you are obsessive and compulsive when it comes to credit card spending, you should keep those older cards around and let the accounts age like fine wine. You don't necessarily have to use those cards - just put them away in a drawer if you have to. Because the length of your credit history is based on the average ages of your total active credit accounts, it's in your best interest to keep old accounts open indefinitely. If you absolutely must cancel a credit card, cancel a newer card instead. Closing out an old account will have the unintended backfire effect of hurting your FICO credit score.

4) Types Of Existing Credit Owned - ( 10% Of Your FICO)

The FICO scoring system favors credit users who are diverse with their usage. The system likes to see users mix it up a little and not just focus on one type of installment usage - like credit cards alone. In general, older individuals with longer credit histories usually tend to have a greater mix of credit account types, thus higher scores. While revolving credit accounts like mortgages and car loans help to inject some diversity into your usage, one shouldn't go out of one's way to mix it up purposely. Focus more on paying all bills on time and limiting your credit usage instead (they comprise 65% of your FICO credit score). In my opinion, this category has the least relevance and the least impact on your overall credit score.

5) New Credit or Recent Credit Sought - ( 10% Of Your FICO )

This is where hard credit checks and soft credit checks come in. Everytime you affirmatively submit an application for a loan or additional credit, a hard credit pull is made against your credit report. The resulting credit pull will have a short term negative hit against your formulated FICO score (in time the score will recover). In general, new and recent requests for credit are seen as risky factors in the eyes of lenders. However, new requests for additional revolving credit that follows a recent late payment will likely cause a more significant drain against your score, as they are seen as ominous signs of financial desperation.

However, the way the FICO system is set up, frequent requests for credit within a relatively short 30 day period is discounted in terms of aggregate negative effects on your credit score. This is to compensate and alleviate the effects of those who are merely interest rate shopping for mortgages or car loans who are likely to submit numerous applications within a short period of time. This is the reason why balance transfer arbitrage seekers are often advised to submit their numerous credit card applications simultaneously within a short period of time to minimize the overall hit against their credit score. As always though, only hard credit checks negatively affect your FICO. Self credit checks initiated by you to examine your own credit report or credit score will never hurt your rating.

What Is Not Considered In Your Credit Score, And How To Boost Your FICO

While the FICO score is a very important factor to those seeking instant approval for credit or a quicker path to the best loan terms and conditions, it's not the end all. Lenders also carefully scrutinize your credit report and other financial factors like income, job stability, education, and amount of money you have in your checking and savings accounts to determine your credit worthiness. That's because many relevant personal risk factors are not appropriately reflected in the credit report or the credit score model compiled by the big three credit reporting bureaus. Such information include age, race, sex, income, savings, marital status, education, and your current type of housing.

The FICO score also struggles with formulating an accurate score representation for new entrants into the credit world. Those with short credit histories like recent immigrants or college students are unlikely to have much of a credit report transcript to work off of. As evidenced by the Fair Isaac Corporation's efforts at formulating and developing its new FICO Expansion Score to gauge the credit worthiness prospects of those with incomplete or thin files, the existing FICO system as is probably still needs some improvement, and is far from perfect. However, until a better thing comes along, consumers need to find ways to improve and keep their credit ratings high. Unless you don't have plans to seek new employment, apply for a new credit card, obtain a home mortgage loan, find a new apartment, or apply for insurance in the next few years, it's in your self interest to improve your FICO credit score and keep it high in case you ever need to use it.

As it is relevant to your ultimate credit score, I'd recommend taking several minutes to download a free credit report at annualcreditreport.com. With this free federal government service, you get to request a single credit report from each of the three major credit bureaus every four months. Instead of requesting all three credit reports at once, you might want to stagger them out to three times a year for continuous monitoring. If you spot an error, notify the bureau (online, by phone or by mail) and the creditor (call and also send a letter) immediately. While your credit score isn't free, there are ways to get get your free credit score from the big three credit reporting agencies. Remember, if you want consistency, stick with the FICO score exclusively for now.

January 1, 1970 at 12:00 am