Lending Club Review - Social Network Peer Loans and Borrowing

Published 3/10/09 (Modified 3/22/11)

By MoneyBlueBook

Borrow Money Or Invest In Interest Earning P2P Loans With Lending Club

With the lowering of interest rates by the Federal Reserve in response to the current economic climate to the lowest levels we have seen in years, the interest rates offered by high yield savings accounts and high interest certificate of deposits are now simply not as attractive as they once were, only a few years ago. With the stock market still suffering from unstable price swings and massive volatility across all sectors, it makes present day sense to look towards alternative investment ideas to make some money.

While I have been a quiet Lending Club member for a few years now since the online company opens its doors to loan investors, I haven't felt the need to review the program until now. Until recently, the top high yield savings account and best CD rates at most banking institutions offered a reliably consistent rate of return on deposits. But with market turmoil ever present and the specter of worsening bank failures looming, I've begun to turn my attention to other investment possibilities in an attempt to diversify my portfolio risk and seek a higher rate of return. The ability to earn a reasonably competitive interest income with the added ability to diversify risk via peer to peer lending networks like Lending Club and Prosper is becoming more and more attractive. At the very least, P2P lending programs offer potential profit seeking investors like myself the ability to play the role of the banker and help people out with their loan needs, while at the same time earning interest income that's higher than what's currently available in a regular savings account or bank CD.

What Is Lending Club and What's P2P Lending and Borrowing All About?

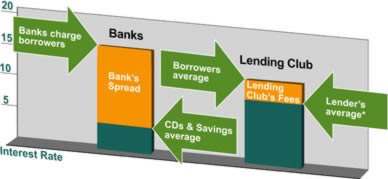

Lending Club is a person to person, also known as a peer-to-peer, lending website that matches ordinary borrowers with ordinary local lenders (who are ordinary people themselves) through a pairing system that combines social networking, a computerized search algorithm, and manual credit worthiness checks. Essentially, Lending Club is a way to offer low interest loan rates to borrowers with good credit, while at the same time offering willing potential lenders like you and I the ability to earn a reasonably high interest rate of return with a relatively low risk of default on the loans that we extend to these borrowers. It's an alternative way (that's growing in popularity) for ordinary Americans to borrow money, get qualified, and get funded for loans expediently without the complex hassles of applying for traditional bank loans or having to deal with the riskier side of 0% balance transfer credit card offers or getting mired into the clutches of payday loans. On the whole, Lending Club offers borrowers better interest rates than can be obtained from any credit card offer, even those that purport to be low interest.

The whole business concept behind P2P lending networks like Lending Club is built on the premise that borrowers will be less likely to default to members of their own local communities. The Lending Club online system offers anonymous borrowers and local micro loan lenders a way to find each other and get matched up based on personal preferential demographic factors like geographic location, educational and professional background, and activity within a particular social network like Facebook (the social networking site where Lending Club had its upstart roots).

Still don't believe Lending Club or peer to peer lending and borrowing programs are legit? Just take a look at a recent article from the Harvard Business Review, which notes the remarkable rise of peer to peer lending programs and documents the rise of such emerging programs as the next big wave of important financial innovations in the coming years, especially in light of the ongoing economic recession and the collapse of traditional lending institutions. It looks like P2P lending is here to stay, one way or another.

My Lending Club Experience - Investing In High Interest Bearing Loans

As a person who's always up for trying out new financial products, I signed up for Lending Club when it first came out and have been using the online service ever since. So far, my Lending Club experience has been pretty positive, yielding fairly respectable returns in the process. Currently, my entire Lending Club participation has only been that of a lender and I have yet to participate as a borrower. However, while I can't comment on Lending Club through my own personal experiences as a borrower, I have had numerous extended online conversations with actual people who have used the Lending Club service for their borrowing needs, primarily to help pay down existing high interest debt. Most of the Lending Club borrowers I've come into contact with have been pretty receptive to the user-friendliness of the Lending Club online platform and pleased with the convenient access to reasonably priced loans that the website affords, particularly when compared to last ditch lending alternatives like car title loans or payday cash advances.

One of the reasons why I slightly prefer Lending Club over other peer to peer lending networks - is its non-eBay auction-like nature. Having to engage in a convoluted bidding process for loan offers or loan investment prospects would inject too much complexity into an online loan matching process that's trying to cater to the ordinary masses. Fortunately for investors in particular, Lending Club offers its loans on a take it or leave it store front basis. If you find a loan and the credit characteristics and interest rate of return strikes your fancy, you can buy it on the spot, or pass.

As primarily an experimental investor and cautious lender, I have mostly sought out high quality, lower risk of default type loans. As a relatively risk adverse lender with an infrequent appetite for riskier loans, I am not to keen on the prospect of any of my loan investments ever defaulting. However, at the same time, I understand that it's a trade off - safer loans generally yield much lower interest rates of return, while riskier loans almost always yield much higher rates of return to compensate for the higher risk of default and nonpayment. The vast majority of my Lending Club loans as a lender have been A-grade, personally-chosen loan investments. Thus far, I have stayed away from using Lending Club's computerized LendingMatch program to pair me with desired loans. I guess I have confidence in my own ability and prefer to retain control, rather than let some computer software do the leg work for me.

Currently, I have a little more than $800 invested into numerous micro loans with local borrowers. I'm always on the look out for high quality, attractive loan prospects but unfortunately, they are not always available. When they do become available, I try to snap them up quickly. These A-grade Lending Club loans have become quite a set of high yielding cash cows for me. Thus far, I've been very lucky and relatively fortunate as none of the Lending Club loans that I've extended have been significantly late or have entered default. Intriguingly, my Lending Club loans have earned me a steady interest rate of almost 8%, which is 2-3 times higher than what I earn with my best CD rates, best high yield savings, and even best money market accounts. As Lending Club continues to grow in popularity, its borrower base will inevitably grow larger in size, and the volume of attractive loan investments are bound to increase. If my default-free track record holds, I may decide to dabble in slightly riskier Lending Club loans in the near future to see if I can snag a higher rate of return but still maintain my default-free streak. Stay tuned!

For those wondering about the prospect of income taxes levied on the earnings off of Lending Club loans - yes, you are personally responsible for paying ordinary income taxes on all interest income that your Lending Club investing activities generate (you are issued a handy 1099 form at tax time).

Setting Up A New Lending Club Account Is Free and Quick

Opening an account with Lending Club is easy and efficient, and as expedient as opening a new online bank account. To open an account and start lending money through Lending Club, you simply submit your personal information, bank name and bank transfer account numbers, along with some optional background information. Thereafter, the account registration process wraps up with the obligatory bank test deposits to verify true bank account ownership

Opening a new Lending Club account for borrowing purposes on the other hand entails a stricter registration process that necessitates that the applicant provide a Social Security Number and other identifying information for a full credit report and���� FICO credit score background check (try looking up your own free FICO credit score beforehand). Though Lending Club imposes a rather strict set of prime standards for borrowers, this attention to credit quality over mere quantity ultimately ensures a better experience and loan exchange for both lenders and borrowers in the long run.

Borrowing Money and Getting A Loan From Lending Club

For prospective qualified borrowers, Lending Club offers an attractive way to obtain a loan at comparatively affordable rates - offers that beat out most personal bank loans and credit card interest rates. However, do be forewarned that Lending Club's qualification standards for borrowers are high grade and rather stringent. Lending Club pretty much only wants prime, or near prime borrowers with good to excellent credit. Those with very bad or subprime credit are probably out of luck when it comes to Lending Club, and will probably have to resort to less than advisable, bottom tier loan alternatives such as bad credit credit cards or payday loan borrowing.

The process of applying for a Lending Club loan is surprisingly straightforward. Approved Lending Club borrowers get a 3 year unsecured fixed interest rate loan, with repayment obligations managed by Lending Club. There is no haggling or negotiations to contend with as you simply submit an application for a loan, and based on your FICO credit score, credit report, and background check, you are offered a fixed interest rate loan to accept or reject. At Lending Club, you can borrow anywhere from $1,000 to $25,000 as an unsecured loan, to be used for just about any purpose, including but not limited to, high interest credit card repayment or small business financing.

To get started as a Lending Club borrower, simply open a new Lending Club account as a borrower, and submit a loan application. At the time of registration, Lending Club will obtain a credit report and FICO credit score check of the borrower in order to rate and assign a credit risk grade (ranging from A thru G) and determine the appropriate interest rate the borrower can solicit on the site. Once approved, the borrower is free to list his or her loan request on Lending Club for prospective lenders to review and examine. During the credit risk scoring process, particular attention is paid to the borrower's credit rating history, the amount of the desired loan balance, and the borrower's current debt to income ratio.

Lending Club's standards for borrowers are high and the program only currently accepts members who can meet the followings status and credit history requirements:

- Must be a U.S. resident.

- Must have a FICO credit score of at least 660, with a debt to income ratio (excluding mortgage) below 25%.

- Credit history report must indicate that you are a responsible borrower.

- Have at least 1 year of credit history, showing no current delinquencies, recent bankruptcies (7 years), open tax liens, charge-offs or collection accounts in the past 12 months.

- Must have no more than 10 inquiries on your credit report in the last 6 months.

- Must have a revolving credit utilization of less than 100%.

- Must have more than 3 accounts in your credit report, of which more than 2 are currently open.

For their middle man loan matching services, LendingClub charges a processing fee (ranging from 0.75% to 3.50% based on Lending Club's assessed credit risk grade), which is included in the annual percentage rate (APR) and is subtracted from the loan proceeds prior to disbursement to the borrower.

Lending Money and Earning A Comparatively High Interest Rate On Lending Club Loans

To qualify as a Lending Club loan investor, you must meet and satisfy certain preliminary state and financial suitability conditions - translation: you must belong to an approved state and/or pass certain income and net worth requirements. With exemptions for certain states such as California, you generally must have an annual gross income of $70,000 or a networth (including your home) of at least $250,000.

As for the state residency requirement, you must be a resident of one of the following states below. Your state not on the list? Fear not - Lending Club has submitted proposals to all states and new ones are being added as they are approved.

- California, Colorado, Connecticut, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Louisiana, Minnesota, Mississippi, Montana, New Hampshire, Nevada,New York, Rhode Island, South Carolina, South Dakota, Utah, Virginia, Washington, Wisconsin, West Virginia, and Wyoming.

As a prospective Lending Club loan investor, you can start with as little or as much money as you'd like. Once you have opened a Lending���� Club account and transferred in the appropriate funds for lending purposes, you will be asked to indicate your level of risk tolerance (credit risk ratings that range from A - G) and prompted to search for loans either manually, or get matched up with prospective loans with the aid of Lending Club's computer algorithm based LendingMatch software. The Lending Match program generates a suggested loan portfolio based on your level of risk desired and your connections with the borrowers in your account. As mentioned above, I have chosen to stick with manual loan evaluations (with great success thus far) as I feel more comfortable with my own ability to assess loan prospects than entrust that duty to a random computer program.

Those who are new to peer to peer lending may wish to start with small incremental investments and tinker a bit with the seesaw effect of risk and interest rate of return, before diving into larger denominational investments. Those who get the hang of it may actually find the loan investment hunting and evaluation process rather interesting and personally rewarding (remember, you are potentially helping out someone who is in desperate need of a loan to get his or her life going again).

There are two loan components that will be of paramount importance to prospective Lending Club loan investors - the interest rate of return offered, and the rate of default risk. The current range of interest rates that Lending Club lenders and investors can potentially earn varies from 7.37% to 20.11% (depending on how risky the loan is in terms of risk of default, as determined by the automatically assigned Lending Club loan grade.

The worst case scenario for any Lending Club loan lender or investor is the dreaded loan default, which occurs when the borrower refuses or is unable to fulfill the obligations of his or her loan principle and interest rate repayment. Lending Club's website indicates that the current overall default rate is less than 3%. However, and probably due to my personal strict and stingy loan evaluation tactics, I have yet to experience a loan default on my Lending Club loan investments. On the downside, I probably earn a much lower interest rate of return on my loan investments than I would be able to garner if I opted to invest in slightly more riskier B and C grade loans.

As a Lending Club loan investor, one of the general statistics and trends I track closely is the company's continuously generated performance stats for all loans. As you can see from the current Lending Club loan stats, Lending Club does a pretty commendable and transparent job of providing updated statistics relating to all late and defaulted loans for all members to review and assess. As the updated loan default statistics demonstrate, rather surprisingly perhaps, the vast majority of loans (particularly the A graded ones) are current and not late or in default. The B and C loans are also not as horrendous in terms of late payments or defaults as one may have assumed. Those who are into mathematics and willing to play the odds of probability may find it worth the slight risk of partial loan default to capture the higher interest rate of return on their investments. As always, smart Lending Club investors ought to spread their loan investments around to minimize the chances that one unexpected loan default will torpedo their entire Lending Club portfolio.

Lending Club Loans Are Now More Liquid Than Ever And Can Be Traded Like Securities

As Lending Club has completed the SEC registration process, all Lending Club notes and loans issued on or after October 14, 2008 can now be purchased and sold as securities, as they now represent Lending Club security investments rather than direct loan obligations of the underlying Lending Club borrower.

As Lending Club has completed the SEC registration process, all Lending Club notes and loans issued on or after October 14, 2008 can now be purchased and sold as securities, as they now represent Lending Club security investments rather than direct loan obligations of the underlying Lending Club borrower.

Now instead of waiting for the 3 year locked in loan commitment notes to reach maturity, they can now be traded on the secondary market through Lending Club's trading platform agreement with FOLIOfn Investments Inc, greatly enhancing their liquidity and versatility as investments. While only loans and notes issued after Lending Club's October 14, 2008 SEC registration date may be traded, in due time, it is reasonable to expect the number of trade-able notes to balloon in the coming future.

For those concerned about the safety and security of their invested loan funds as a lender in the event of a Lending Club failure or bankruptcy, Lending Club actually addresses this issue on their webpage. According to Lending Club, in the event the company, for whatever reason goes out of business or is no longer able to continue servicing loans, in order to ensure continuity, Lending Club has a backup servicing and successor agreement with Portfolio Financial Servicing Corporation (www.pfsc.com) for PFSC to take over loan servicing.

While the Lending Club business entity itself is still burning through venture capital cash like it's going out of style, particularly as it focuses on promoting the growth and adoption of peer to peer lending, I personally think the concept of P2P social network lending is here to stay. Whether companies like Prosper or Lending Club will be around forever, or whether they ultimately will be bought out by more traditional banks eager for a piece of the peer lending pie, remains to be seen.

January 1, 1970 at 12:00 am