Increase Your Citibank Card Limit Automatically Without a Hard Credit Pull

Published 11/17/07 (Modified 3/9/11)

By MoneyBlueBook

I'm a big fan of Citibank and I really like the variety of financial products they offer. I like the fact that they have a national banking presence and that's one of the reasons why I have my primary checking and savings account with them. I especially like their credit cards since many of them provide unique credit card offers not available with any other company. Citibank also has a nice website that offers many convenient features for its customers. One of the nice functions is the option to request an automatic credit limit increase online without the need for a hard credit pull. When you request automatic limit increase through your Citibank online account, only a soft inquiry is made of your credit report.

This a wonderful feature since not all credit card companies offer this automatically. Other issuers will increase your limit upon request, but the manual request usually involves a hard credit inquiry.

Why Would I Want to Increase My Credit Limit?

The most obvious reason you would want to increase your credit limit is to enhance your ability to make more monthly purchases or to purchase more expensive items using your card. If you started out with a low credit limit and find yourself frequently nearing or reaching your maximum limit, a credit increase would likely be beneficial. Another reason would be to improve your FICO credit score by lowering your overall credit utilization ratio. Credit utilization ratio is a major component used to compute your FICO credit score, and you can help to lower that ratio by increasing your maximum credit limit.

How Do I Do It?

Requesting an automatic credit limit increase through Citibank is very easy. Citibank routinely runs soft credit inquiries on your credit report that has no negative effect on your credit score. They run soft credit checks every few months to determine if you may be pre-approved for incremental credit limit increases. However, you need to formally request the increase to put the pre-approved raise into effect. Here is how you do it:

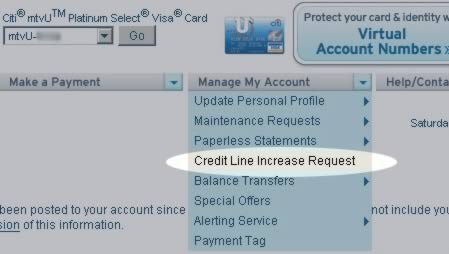

Log into your Citi credit card account and select the appropriate Citi card (if you have more than one Citi card like I do). Next, look at the horizontal menu bar. Under Manage My Account, select Credit Line Increase Request. At this point, either one of two things will be displayed on your screen. Either the system will congratulate you and automatically bump up your credit limit, or the system will request that you fill out additional financial information for a manual review. If you get the manual review option, it either means you have a shaky credit score and are unable to pre-approve, or it means that you requested an increase too recently ago.

If you are automatically approved, your credit score won't be affected and you'll get the automatic increase. But with the manual review, you'll need to state your income and bank information so Citibank can run a manual credit check to see if you qualify for a limit increase. Unfortunately, with the manual review, they will make a hard credit check . Of course, you can always decline and nothing will happen.

January 1, 1970 at 12:00 am