Credit unions - better than you might think

By Gina Pogol

As a business writer and editor, I spend a large part of my day keeping up with economic news (these days that usually involves watching helplessly as financial poop hits the proverbial fan) and working up a lot of indignation over the country's economic state. So it's been a very long time since I spared a thought for credit unions, but they're worth paying attention to.

Credit unions: the historical prospective

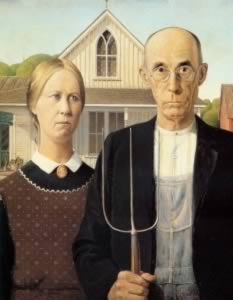

Credit unions were a natural outgrowth of the medieval guild system in Europe, which provided business services to their members. The first modern credit union was formed in Germany during the Industrial Revolution in 1864, and the first credit union in the U.S. was started in Massachusetts in 1909. However, credit unions were slow to win acceptance here, probably because Americans like that whole rugged individualism thing and co-ops are for sissies...

Credit unions: yawn

Traditional, yes -- but credit unions are not sexy or hip. They don't have mascots and they don't own football stadiums. You won't find a lot of bells and whistles and gee-whiz at your local credit union. But you also won't find a CEO making gazillions of dollars while amassing a worthless subprime portfolio and begging for a bailout.

What makes credit unions different?

Credit unions are run for the benefit of their members. Here is a list of the characteristics that define credit unions:

- Non-profit cooperatives

- Owned by members

- Run mostly by volunteer board members

On the other hand, most depository institutions are:

- Profit-driven

- Owned by outside shareholders

- Run by paid board of directors

The idea is that credit unions can pay high interest on savings accounts and charge less for loans because they don't have to turn a profit, and as non-profit organizations they don't have to pay taxes. They also don't require huge marketing budgets and they don't run around Wall Street looking for other banks to take over.

Credit unions are typically created for the benefit of specific communities, such as employees of a company, members of an organization, or residents of a neighborhood. Membership is limited to those who are part of that group.

Disadvantages of credit unions

Okay, so credit unions are warm fuzzy money clubs, but it's not all roses and puppies. You won't find jillions of ATMs all over the country for your banking convenience. They don't have branches on every other corner. Deposits at credit unions are usually insured, but not always. And even those that are may not be to the extent that deposits at FDIC-insured banks are.

They don't usually offer the range of services that big banks do -- you might be treated to a blank stare if you ask about direct deposit or getting your canceled checks returned to you. Credit unions are known for being very conservative in their loan underwriting. Membership may have its privileges, but it won't get you a mortgage or car loan if your credit is skuzzy.

Advantages of credit unions

Credit unions can be sort of like Cheers, where everybody knows your name. Their service is often better than banks -- if you ask your regular bank for recommendations or advice, you might not be told everything you should know, as that's not always in the bank's best interest.

Banks' raison d'etre is to make money for their shareholders and they are supposed to do that in every legal way possible. But credit unions have no reason not to help you as much as they can, because they answer to you! You can open a savings or checking account at many credit unions with a single dollar.

Finally, I have heard but have not verified that credit unions serve better cookies.

How do you choose the best credit union?

If you want to check out a credit union, your first task is discovering which ones you qualify to join. Go to CreditUnionCoop.com to see which ones might accept you and then compare their offerings.

If your money's safety is a primary concern, pick a credit union insured by the federal government through the National Credit Union Administration (NCUA). Most of them are. Look for an NCUA blue sticker on the window or just ask the nice people who work there. The NCUA is to credit unions what the FDIC is to banks. If you've got big bucks, find out what the coverage limits are for each type of account.

Investigate the range of services provided. Note: a limited range of services is not necessarily a bad thing. Some credit unions, tired of being the maiden aunts of the financial world, have revved up their profiles and their advertizing and stepping up the fees to pay for it all. The more provincial organizations often serve up the best deals on plain vanilla products like savings accounts and car loans.

The bottom line is that the services offered should mesh with your needs. Remember, too, that you can always take advantage of your credit union's best CD rates and high-yield savings while maintaining a convenient checking account at Behemoth Bank.

Finally, visit the branch you are most likely to use (not everyone prefers to bank online, I'm just sayin') and check out the cookies.

Gina Pogol has been writing about mortgage and finance since 1994. In addition to a decade in mortgage lending, she has worked as a business credit systems consultant for Experian and as an accountant for Deloitte. She graduated with High Distinction from the University of Nevada with a BS in Financial Management.

January 1, 1970 at 12:00 am